How Apple Pay, Google Pay are enabling e-commerce in South Africa

Summary: This post explains how Apple Pay and Google Pay support e-commerce growth in South Africa. It focuses on speed, security, and improved checkout experiences.

The state of pay in South Africa

E-commerce in South Africa has seen rapid and consistent growth, as consumers become more and more comfortable paying online. Along with this growth comes an expectation for easy, fast and accessible online shopping and payment experiences.

South Africa's e-commerce landscape is experiencing rapid growth, with digital wallets like Apple Pay and Google Pay reshaping how consumers interact with online retailers, with 6.38 million new e-commerce users expected in 2024 and the market projected to exceed R400 billion in value by 2025, according to the Daily Investor, the industry is on a significant upward trajectory. This reflects not only the global trend toward online shopping but also a growing demand for simpler, more convenient checkout experiences.

The majority of online payments are still card payments in South Africa today, which, while functional, can often involve friction. Consumers must manually input card details, expiration dates and CVV codes — and often go through 3DS, or 3D Secure, to input an OTP and secure the payment. This process can feel cumbersome, especially on mobile devices. Card payments also see incidents of fraud, leading to chargebacks for the retail business.

As e-commerce sellers know, any added effort during the checkout process can result in cart abandonment. As the final step in the process, payments must be friction-free and tailored toward consumers in the way they prefer to shop. According to a recent Statista survey (January 2025), 77% of South African consumers used their mobile phones to shop online, while over half indicated doing so on their laptops. With such high mobile usage, frictionless, mobile-first payment solutions are no longer optional—they’re essential.

The growth of Apple Pay and Google Pay in South Africa

Digital wallets, such as Google Pay and Apple Pay, address this need by integrating payment credentials directly into mobile and wearable devices. With just a tap or biometric confirmation, such as Face ID or Touch ID, consumers can complete transactions securely and seamlessly. This eliminates the need for manual entry and 3DS, making the checkout process faster and reducing cart abandonment. It also results in more secure payments.

When a customer attempts to make a payment, the last thing a business wants is for that payment to fail, resulting in an incomplete payment and the possibility that the customer walks away at that step. That’s why conversion rate is critical for payments. Higher conversion means higher revenue.

Stitch Express (formerly WigWag), has conversion rates of approximately 94% with digital wallets, far exceeding industry standards across various payment methods – and significantly higher than the rate for card transactions.

Consumers have also shown a strong demand for digital wallets. For Stitch Express merchants,, over 30% of transaction volume shifted from card to wallet usage after enabling these methods.

This also highlights the importance of a streamlined, high-converting checkout experience. Offering too many payment methods can overwhelm users, while focusing on the ones they value most leads to higher sales, faster checkout, and a smoother overall experience.

The rapid adoption of digital wallets is driven by evolving consumer expectations. Today’s shoppers prioritize efficiency and security over outdated, repetitive processes. They want quick, one-tap solutions that save time and protect their data. While digital wallets rely on card processing infrastructure, they add a layer of convenience through encrypted transactions and eliminate the need to re-enter sensitive details across multiple platforms.

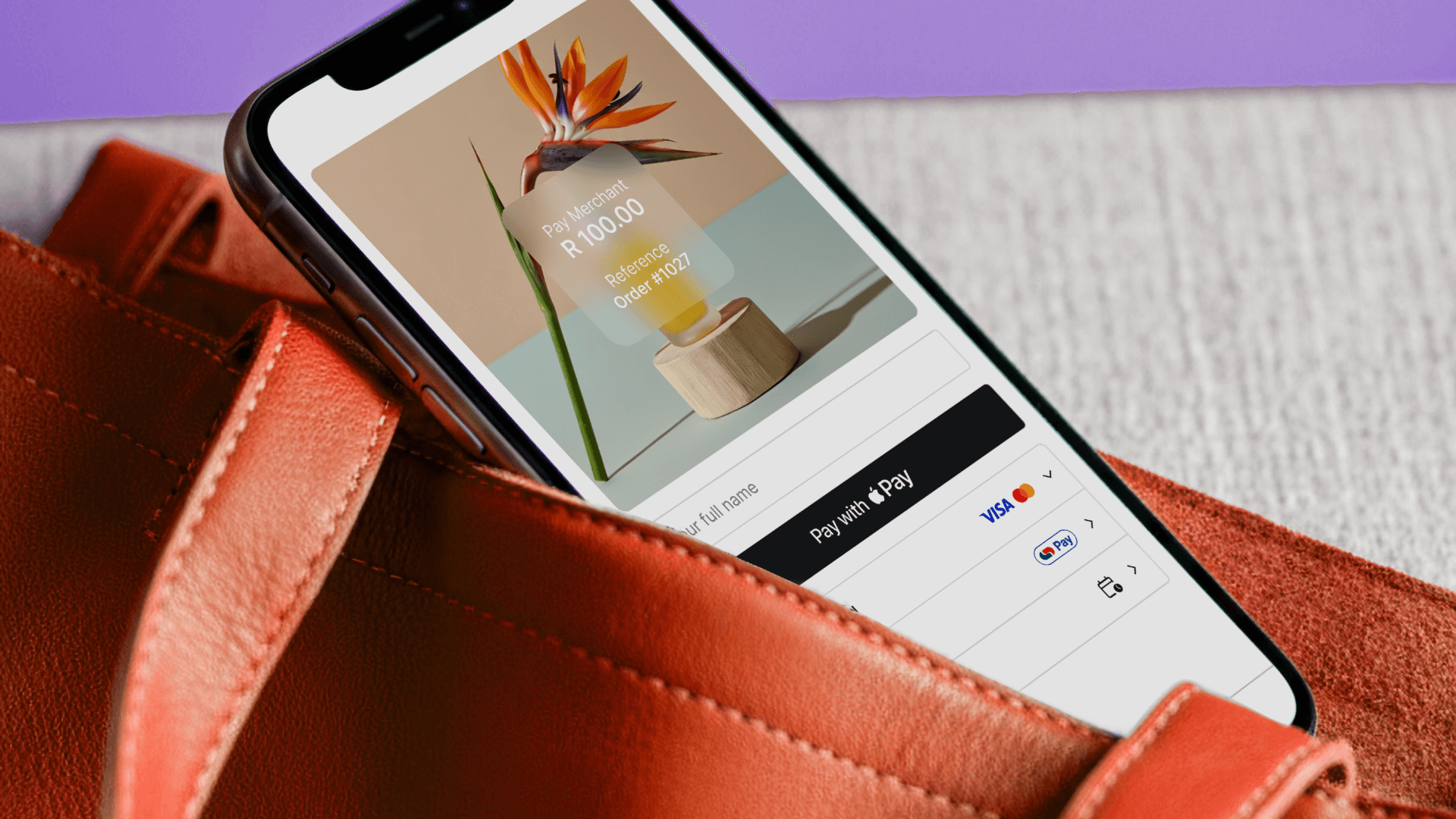

Apple Pay and Google Pay on Stitch Express

To meet this demand, Stitch Express has made digital wallets a cornerstone of its payment offering. By integrating high-converting options like Apple Pay, Google Pay, and Capitec Pay, we empower merchants to cater to their customers' preferences.

Beyond these methods, we’ve introduced features designed to further reduce checkout friction. For example, our “Remember me” function retains customer details, requiring only a simple OTP or in-app authentication for returning shoppers, speeding up repeat transactions.

Additionally, merchants using Stitch Express can customize their checkout experience to maximize conversions. They can organize and rename payment providers, ensuring customers see familiar methods first, rather than defaulting to the platform's branding. This clarity enhances trust and minimizes confusion, encouraging higher completion rates.

This approach also builds loyalty and credibility. Shoppers recognize when a platform prioritizes their convenience and security, and merchants benefit from increased conversion rates, reduced cart abandonment, and long-term customer satisfaction and retention.

Digital wallets – and alongside them, momentum toward more efficient payment experiences – are enabling e-commerce in South Africa, while setting a new standard for seamless payments. Merchants who embrace these solutions will not only stay competitive but thrive in this evolving market.

FAQs

How are Apple Pay and Google Pay enabling e-commerce in South Africa?

They simplify online checkout by allowing customers to pay quickly using stored payment details, reducing friction and increasing completed purchases.

Why do digital wallets improve e-commerce conversion?

Digital wallets reduce checkout steps, support biometric authentication, and increase trust, all of which contribute to higher conversion rates.

Are Apple Pay and Google Pay secure for online payments?

Yes. Both use tokenisation and device-level authentication, protecting card details and reducing fraud risk.

Which merchants should support Apple Pay and Google Pay?

Online retailers, marketplaces, and subscription businesses benefit from offering digital wallets to meet modern consumer expectations.

Do Apple Pay and Google Pay work across devices?

Yes. They support payments across mobile, tablet, and desktop environments where supported, enabling consistent checkout experiences.

Is digital wallet adoption growing in South Africa?

Yes. As contactless and mobile payments increase, digital wallets are becoming a standard part of the South African e-commerce landscape.

Elevate your e-commerce experience with Stitch Express